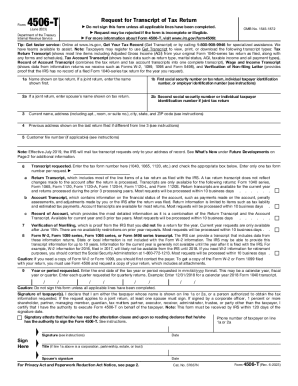

IRS 4506-T 2024-2025 free printable template

Show details

Please visit us at IRS.gov and click on Get a Tax Transcript. under Tools or call 1-800-908-9946. Where to file. After this date masked Tax Transcripts will only be mailed to the taxpayer s address of record. If a third-party is unable to accept a Tax Transcript mailed to the taxpayer they may either contract with an existing IVES participant or become an IVES participant themselves. We have teams available to assist. Note Taxpayers may register to use Get Transcript to view print or download...

pdfFiller is not affiliated with IRS

Instructions and help about IRS Form 4506-T

How to edit the 4506-T Form PDF with pdfFiller

How to fill out Form 4506-T in 2025

Video tutorials for completing IRS tax forms

Instructions and help about IRS Form 4506-T

Form 4506-T, the Request for Transcript of Tax Return, is an essential tool for taxpayers seeking various tax transcripts, such as tax returns, accounts, and income records from the IRS.

How to edit the 4506-T Form PDF with pdfFiller

Effortlessly edit the IRS 4506-T Form online using pdfFiller’s robust PDF editor. We will guide you through the process with ease. Follow these clear steps:

01

Access your pdfFiller account, and if you're a new user, you can easily sign up to gain access to a comprehensive suite of document editing tools.

02

Click the "Get Form" button on the page to open your form. This launches our interactive online editor for seamless editing.

03

Easily modify your form by inserting new text or adjusting existing content.

04

After completing your edits, click DONE to ensure your changes are saved.

05

Download 4506 T form PDF, email it directly, or save it to the cloud for convenient access and secure storage.

Effortlessly edit IRS 4506 T form online with pdfFiller, enjoying the convenience and efficiency of seamless document management.

How to fill out Form 4506-T in 2025

Filling out Form 4506-T correctly is essential for obtaining your IRS transcript online efficiently and securely. Here's a detailed guide to help you through the process:

Step 1: Gather the required information

Before you begin, ensure you have all the necessary details on hand:

01

Your personal information, including name, Social Security Number (SSN), and address

02

The tax year for which you require the transcript

03

A Customer File Number, if applicable, for third-party use

Step 2: Complete the form

01

Get your Form 4506-T on pdfFiller and fill it out digitally.

02

Line 1-4: Enter your personal information accurately. Make sure your name and SSN match those on your tax return.

03

Line 5: To send the IRS transcript to a third party, enter their details here and include a Customer File Number for added security.

04

Line 6: Select the type of tax return transcript you need by checking the appropriate box.

05

Line 7: Specify the tax years for which you are requesting transcripts.

06

Line 8-9: If applicable, enter any additional information required for validation.

Step 3: Review for accuracy

Double-check all entered information to ensure accuracy. Mistakes can delay processing or result in incorrect data being sent.

Step 4: Sign and date the document

The form must be signed and dated. If filing jointly, both parties need to sign.

Step 5: Submit the form to the IRS

Mail your completed IRS Form 4506 T printable to the address specified in the instructions, which varies depending on your location and the type of tax return transcript requested. Alternatively, you can submit the form electronically using pdfFiller if that feature is available.

Important Tips:

01

Ensure compliance with IRS guidelines by thoroughly reviewing their instructions for Form 4506-T.

02

Keep a copy of the completed form for your records.

03

For assistance, consider consulting a tax professional to ensure accuracy and compliance.

Following these steps will help ensure your request for copy of tax return is processed smoothly and securely. For any changes or updates, always refer to the IRS official website.

Video tutorials for completing IRS tax forms

Show more

Show less

Recent Updates for 4506-T Form

Introduction of customer file number

Changes in IRS transcript mailing procedures

Secure handling and communication methods

Engagement to data protection

Recent Updates for 4506-T Form

Recent updates to the form focus on enhancing the privacy and security of taxpayer data. A significant change includes concealing full taxpayer identification numbers on transcripts to protect against identity theft while maintaining the visibility of financial data for tax-related activities.

Introduction of customer file number

Introduced to further safeguard data, the Customer File Number allows third parties, like lenders, to associate transcripts with a taxpayer's record without exposing sensitive personal information. This unique identifier is visible on transcripts, facilitating secure document matching.

Changes in IRS transcript mailing procedures

The IRS has stopped mailing transcripts to third parties since July 2019 to enhance data security. Taxpayers must now receive transcripts directly at their address of record or manage third-party requests through the Income Verification Express Service (IVES).

Secure handling and communication methods

To ensure secure handling, the IRS prohibits faxing transcripts and emphasizes direct communication methods, such as online accounts and automated phone services. Additionally, taxpayers and tax professionals must adhere to specific signing requirements, maintain proper authorization documentation, and meet submission deadlines.

Engagement to data protection

These updates underscore the IRS's commitment to protecting taxpayer data and streamlining the IRS transcript online request. Taxpayers are advised to regularly check the IRS official website for the latest information and any new operational changes related to Form 4506-T.

Show more

Show less

All you need about IRS Form 4506-T

What is the Form 4506-T?

What is the purpose of the IRS 4506-T Form 2025?

Who needs to file 4506-T?

When am I exempt from filling out Form 4506-T?

Components of the 4506-T tax form

When is Form 4506-T due?

What information do I need to complete the 4506-T Form?

Do other forms accompany IRS Form 4506-T?

Where to send the 4506-T Form?

All you need about IRS Form 4506-T

IRS Form 4506-T, also known as the Request for Transcript of Tax Return form, is an essential document taxpayers and tax professionals use to request copies of their past tax returns or transcripts.

What is the Form 4506-T?

Form 4506-T allows individuals and businesses to obtain tax transcripts directly from the Internal Revenue Service (IRS). These include transcripts of tax returns (Form 1040 series), wage and income statements (Form W-2), and account transcripts showing any adjustments made to previously filed returns. The form must be completed accurately and signed by the taxpayer or authorized representative to be processed by the IRS.

What is the purpose of the IRS 4506-T Form 2025?

The IRS 4506-T Form aims to provide individuals and businesses with a way to request their tax transcripts from the IRS. These transcripts are often needed for financial purposes, such as applying for a loan, mortgage, or financial aid. They can also help verify income history or resolve any discrepancies with tax returns. By filling out this form and submitting it to the IRS, taxpayers can easily obtain important information regarding their past tax filings.

Who needs to file 4506-T?

Anyone who needs to verify their past tax returns or obtain their tax transcripts can file the IRS 4506-T Form. This includes individuals, businesses, and authorized representatives acting on behalf of these entities.

When am I exempt from filling out Form 4506-T?

In some situations, individuals may be exempt from filling out the IRS 4506-T form. These include:

01

Requests for transcripts for a deceased taxpayer: If you are requesting tax transcripts of a deceased individual, you do not need to fill out Form 4506-T. Instead, you can request these documents by submitting Form 4506-F.

02

Joint filers requesting separate transcripts: If you and your spouse filed joint tax returns but now require separate tax transcripts, only one person must fill out Form 4506-T. The other person can be listed as the 'Third Party Requester' on the form.

03

Financial hardship cases: In some cases of financial hardship, the IRS may waive the requirement to fill out Form 4506-T. This typically applies to individuals experiencing extreme financial hardship and cannot afford to pay for the tax transcripts.

04

Disaster relief requests: If you have been affected by a federally declared disaster, such as a hurricane or wildfire, you may be exempt from filling out Form 4506-T. Instead, you can submit your request for tax transcripts through the IRS' Disaster Assistance Hotline.

05

Taxpayers with an overseas address: If you have a foreign address and need to request tax transcripts, you do not need to fill out Form 4506-T. Instead, you can use Form 4506-T-EZ or send a written request to the IRS office in Austin, Texas.

Components of the 4506-T tax form

There are several key components included in the IRS Form 4506 T printable that you should be aware of:

01

Taxpayer information: This section requires the individual or business to fill out their name, address, and Social Security number (or employer identification number) accurately. It also includes their current phone number and previous address, if applicable.

02

Transcript type: Here, you can specify which type of information you want to receive from the IRS. This includes tax return transcripts, tax account transcripts, record of account transcripts, and wage and income transcripts.

03

Tax years requested: You can request information for up to four previous tax years on one form. Make sure to indicate which specific years you need in this section.

04

Third-party designee: If you authorize someone else to receive your tax information, such as a lawyer or accountant, their name and contact information must be provided in this section.

05

Signature and date: The last step is to sign and date the form before submitting it. If a third party submits it, they must also sign and provide their relationship to the taxpayer.

When is Form 4506-T due?

Form 4506-T is typically due by April 15 of the current tax year. However, if you are filing for previous tax years, submitting the form as soon as possible is recommended to allow ample time for processing and receiving your transcripts. It is important to note that certain financial institutions or government agencies may have specific deadlines for requesting transcripts, so be sure to check with them before submitting Form 4506-T. Failure to submit the form on time could delay obtaining your tax information.

What information do I need to complete the 4506-T Form?

To successfully complete the Form 4506-T, taxpayers must provide their personal information, including name, social security number, address, and phone number. They will also need to specify the type of transcript they are requesting and for what years. If an authorized representative fills out the form, they will need to provide their information and authorization from the taxpayer. It is important to double-check all information before submitting the form to ensure accuracy and avoid delays in processing.

Do other forms accompany IRS Form 4506-T?

Yes, other forms may need to accompany the Form 4506-T, depending on the purpose of your request. For example, if you are requesting tax information for a business or corporation, you will need to include a separate form, such as Form 8821 or Form 2848. It is important to carefully read and follow the instructions for each form to ensure that all necessary documents are included and prevent delays in processing. If you have any questions about which forms you need to submit with your Form 4506-T, it is recommended to consult with a tax professional or contact the IRS directly for assistance.

Where to send the 4506-T Form?

The address to send the Form 4506-T will vary depending on the purpose of your request and where you live. You can find the correct address for your specific situation on the instructions page of the Form 4506-T or by contacting the IRS directly. It is important to ensure you are sending the form to the correct address to avoid delays in processing. Additionally, it is recommended to use certified mail or a reputable delivery service when mailing important documents, such as tax forms. This will provide proof of delivery and help ensure your form reaches its intended destination.

Show more

Show less

FAQ

How long does it take to get a 4506-T Form from the IRS?

The processing time for a Form 4506-T can vary depending on the current workload at the IRS. Typically, it takes about 5-10 business days for the form to be processed and sent to you. However, it may take longer during peak tax season or if there are delays in processing. It is important to submit your request early to allow enough time for processing and receiving the form before any deadlines. You can also check the status of your request by contacting the IRS directly.

Is 4506-T for individuals or businesses?

Both individuals and businesses can use the 4506-T form. It is commonly used to request tax return transcripts, wage and income information, and other tax-related documents from the IRS. Whether you are an individual or a business, you may need this form for various reasons, such as applying for a loan or mortgage, resolving issues with your taxes, or verifying income for government assistance programs. It is important to fill out the form accurately and completely, regardless of whether you are an individual or a business entity.

How do I file IRS Form 4506-T?

Please submit the form directly to the IRS at the address or fax number listed for your state of residence, where your return was filed. The IRS will mail you a copy of the document you have requested. You will then submit all pages of that document to the Financial Aid & Scholarship Office for review.

Do all lenders require Form 4506-T?

The Form 4506-T is primarily used for individuals, but businesses can also use it to request tax information. The Internal Revenue Service (IRS) uses this form to obtain a full or partial copy of your tax return for a specific year. Lenders, financial institutions, and government agencies often request it for verification purposes.

Does everyone have to sign a 4506-T?

Yes, in most cases, both the taxpayer and their spouse (if married filing jointly) must sign the Form 4506-T. However, there are some exceptions where only one signature is required, such as when requesting tax information for a deceased individual or if an authorized representative filed the request for a copy of a tax return on behalf of the taxpayer. It is important to carefully read and follow the instructions on the form to ensure all necessary signatures are provided.

Where can I find my 10-digit customer file number?

Your 10-digit customer file number can typically be found on your tax return or any correspondence you have received from the IRS. If you cannot locate it, call the IRS at their toll-free number and request it. Having this number when filling out Form 4506-T is essential as it helps the agency identify and retrieve your tax records accurately. In some cases, if you do not know your customer file number, you may still be able to request for copy of tax return using other identifying information, such as your social security number or date of birth.

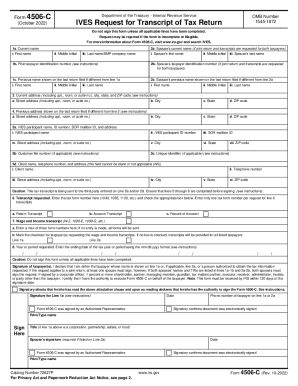

Does 4506 C replace 4506-T?

Yes, Form 4506-C has replaced Form 4506-T for specific purposes. As of February 1, 2021, the IRS requires Form 4506-C for mortgage loan files, and Form 4506-T is no longer acceptable for these transactions. This change is part of the IRS's efforts to streamline processes and enhance security.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself.

Emails are not coming through. I have to send 4-5 times to receive.

PDFfiller has made it easy and efficient to fill out PDF forms

Fill out IRS Form 4506-T